It is fair to say that there has been a lot of talk about Microsoft (MSFT) in the past couple of weeks. With the steady decline in the sales of PC , the companies in the Technology Industry are desperately searching for new outlets to generate profit. This uncertainty is causing people to be concerned with questions of the following nature: Can Microsoft effectively penetrate the tablet market? Is Microsoft as good as it's financials suggest?

I've decided to address these issues and hopefully appease the worried minds.

Microsoft and the tablet market

It appears that tablets continue to captivate consumers as the market shifts towards smaller and more portable computer systems. Realizing this phenomena, Microsoft introduced the basic Surface, running windows RT, which is receiving mixed reviews thus far.

Additionally, the company is expected to launch the Surface Pro, running windows 8, in the coming weeks. The Surface Pro was reviewed by David Pogue of New York Times, one of the most influential technology writers in the world. Pogue was very lavish in his comments of the tablet. Among his observations, Pogue referred to the new Surface as "an entirely new kind of machine, one with possibilities". He also noted that "What really makes the tablet/PC concept sing, of course, is the famous surface keyboard cover"; a point that is worth taking hint of.

As Mr Pogue was quick to notice, in addition to running the tablet on one of the most advanced and user-friendly interface, Microsoft pays a great deal of attention to the design as well, which is a key factor in this market. With this new product, Microsoft is appealing to consumers' needs; which could only mean foreseeable profit.

Not to mention that New York Times is referring to this new version of the tablet as a "Home Run!" (Even the Ipad mini didn't receive such praise).

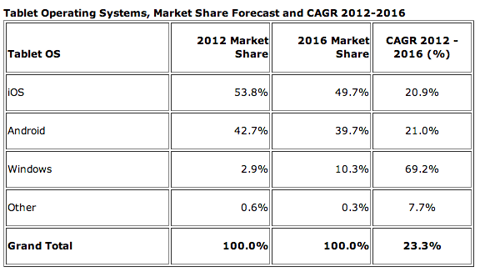

(click to enlarge) Source: IDC Worldwide Quarterly Tablet Tracker, December 5, 2012

Source: IDC Worldwide Quarterly Tablet Tracker, December 5, 2012

Though this could be argued as vaguely optimistic, the numbers suggest that Microsoft will dominate the tablet market thanks to its innovative measures in the near future

It is now clear that Microsoft has explosively positioned itself in the tablet market and it ready to rip the profit.

Financial Strength

The financials of Microsoft reveal a firmly positioned company with a productive business model.

Let's begin with an analysis of Microsoft's keys fundamental ratios

Microsoft takes care of its debts

One of Microsoft's strong points is its ability to meet short term liabilities. This could be observed with a technique often referred to as the quick ratio test, which simply requires one to conduct the following computation: (current assets-the inventory) /firm's current liabilities, and obtain a quick ratio of 2.68. This ratio indicates that for every dollar of Microsoft's current liabilities, the company possesses $2.68 of very liquid assets to cover those immediate obligations.

| MSF | Industry Median | Weighted Average |

| 2.68 | 1.27 | 1.42 |

Cash to Debt of Microsoft: 5.6

In addition to the ability to cover its short-term liabilities, Microsoft is also fully capable to cover its current and long-terms liabilities with quite an ease. In the attempt of getting a good sense of Microsoft's debt coverage power, let's take a look at the company's free cash flow in relation to the totality of its current debts.

Though Microsoft has took on some debts over the past three years, a look at the financial statements reveal that Microsoft is more than able to handle these liabilities. Let's remember that this is a company that enjoys a top credit rating from the Standard & Poor's and Moody's investor's service (triple A credit rating). This allows Microsoft to issue debts with very low interest rates.

Microsoft ability to transform Revenue into cash

Free Cash flow to Sales : 0.40

A close look at the balance sheet reveals that Microsoft ended their 2012 fiscal year with 63 billion in cash and equivalent with a total debt of roughly 12 billion, not to mention that Microsoft has a (Fitch) triple A rating which allows them to issue bonds at significantly low rates. With an actual market cap of roughly, on the conservative side, 256 billion, Microsoft is valued at 205 billion-this number is obtained by taking the market cap minus cash& equivalents plus debts--and has a cash position of 51 billion.

While MSFT enjoys a Free Cash flow to Sales of 0.40, the Median of the Industry is 0.06 with a weighted average of 0.16. These numbers illustrate Microsoft's ability to generate cash through its operations.

Operating Cash Flow& Free Cash Flow

Looking at the fiscal year 2012, Microsoft generated $31.6 billion in cash from operations, and spent $2.3 billion on capital expenditures - resulting in free cash flow of $29.3 billion. In order to get a better outlook on the strength of this free cash flow, let's look at the average of over the past 5 years. In doing so, we obtain 22.8 billion in free cash flow, which is pretty good indicator. Using a statistical reasoning, since the current numbers are very close to the mean, we can conclude that the Microsoft's Free Cash flow does not fluctuate as much. This works as a good insight for making future projections of their Free Cash.

Profitability and Growth

Microsoft constantly increase its revenue

Microsoft has proven to be a profitable company over several decades. Looking at the financial statements of the past 10 years, we see that Microsoft has consistently grown its revenue and kept their costs relatively low.

Ranking companies based on consistent revenue and earnings growth, Microsoft is ranked higher than 72% of the 188 companies in the Software industry.

Microsoft's Operational Efficiency

Looking at 10 years of Microsoft's history, we observe a company with a solid business model that's been able to generate above average income. Enjoying an Operating margin of 29.52, compared to an industry median of 8.05 (Number obtained by computing Operating Income over Revenue), I ranked Microsoft higher than 93% of the companies in the Software Industry.

Microsoft's Health and Competitiveness

Although Net Income and Earnings Per Share (EPS) are the most widely used parameters in profitability valuation, it carries a huge risk of manipulation since earnings can be manipulated easily by adjusting numbers for depreciation, depletion and amortization. To avoid such risk and have a better sense of the company's actual profitability, the long term trend of margin would be a better indicator.Microsoft enjoys a net margin of 21.71 while the Industry median is about 5.09. This type of profit couching is nothing new for Microsoft as the following numbers suggest .

| Year | Net Profit Margin |

|---|---|

| June 2003 | 31 billion |

| June 2004 | 22.2 billion |

| June 2005 | 30.8 billion |

| June 2006 | 28.5 billion |

| June 2007 | 27.5 billion |

| June 2008 | 29.3 billion |

| June 2009 | 24.9 billion |

| June 2010 | 30 billion |

| June 2011 | 33.1 billion |

| June 2012 | 23 billion |

What does this say about MSFT?

Microsoft is a Giant in the Tech Industry. This is a company that was founded in 1975 and has been a pioneer in technological innovations ever since. With the shift in consumer preference, from PC to tablets, Microsoft has managed to positioned itself quite favorably with the introduction of the Surface RT and Surface Pro.

As the financial analysis suggests, the company operates on a successful business model that has consistently generate profit over the years. Microsoft has an impressive cash power along with a triple A credit rating,which allow the company to invest in researches leading to innovations.

Though Microsoft has been off the radar over the past years, it still maintains it position as a Tech Giant and I suggest you "hold" on to the stock.

Disclosure: I am long MSFT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Source: http://seekingalpha.com/article/1113471-will-the-surface-pro-help-resuscitate-microsoft?source=feed

bear grylls us news law school rankings gael glen rice jr bars lindzi cox bachelor finale

No comments:

Post a Comment